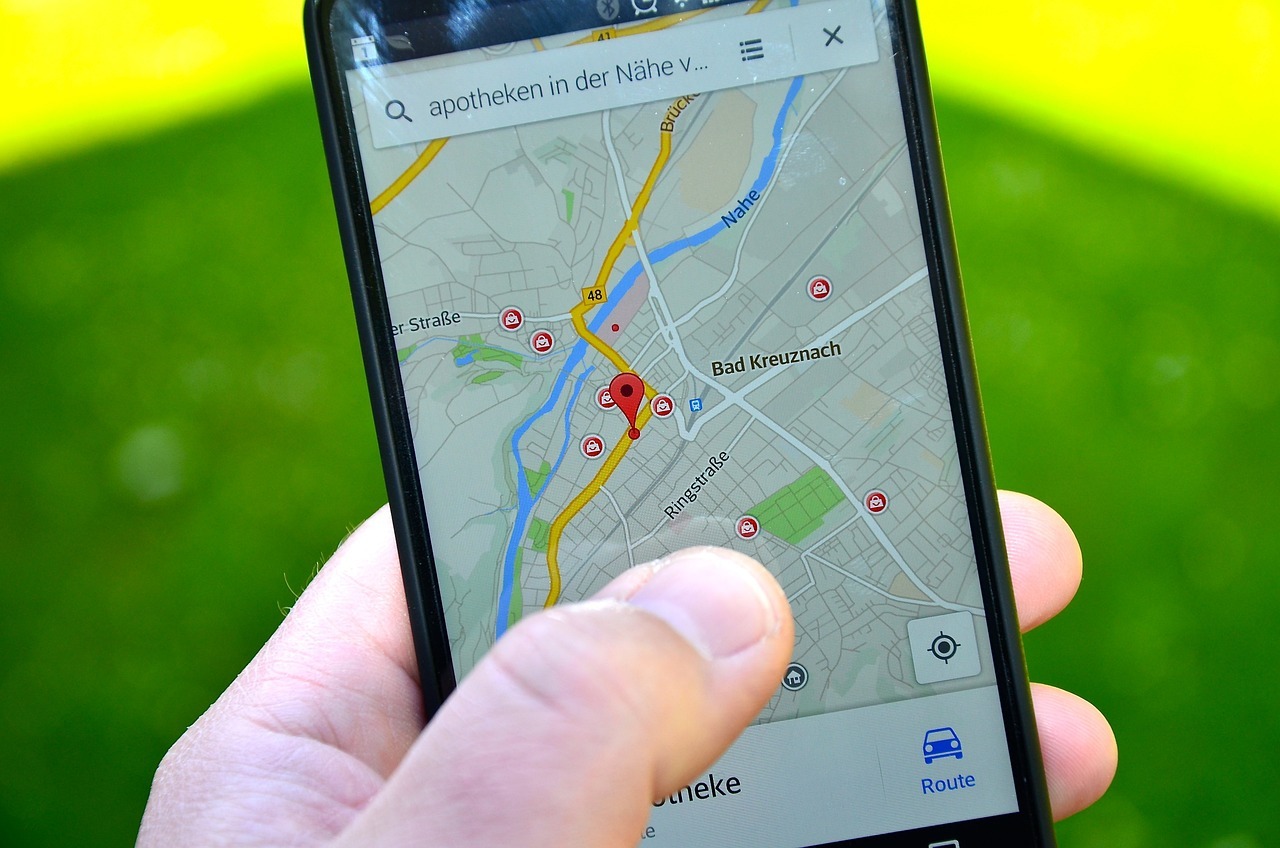

Assess the ideal location for your business

Your business location will impact taxes, regulations, and zoning laws. Careful consideration of the state, city, and neighborhood where you choose to establish your business is crucial. Factors to take into account include proximity to suppliers and customers, market demand, competition, workforce availability, transportation, and costs of doing business.

In addition, you should investigate the different government agencies that might affect your business operations, such as licensing and permit requirements.

Conduct Research to Determine the Best Location

It’s crucial to choose a location that aligns with your business goals and targets. This includes taking into account the location of your intended market, your business partners, and your personal preferences.

Additionally, you’ll need to factor in the costs, benefits, and restrictions of different government agencies since your location can impact your tax rates, zoning laws, and regulations.

Account for Region-Specific Business Expenses

Consider that the cost of operating a business may differ based on your location. For instance, standard wages (minimum wage laws), property values, rents, business insurance, utilities, and government licenses and fees may vary depending on the region.

As a result, it’s important to calculate your startup costs and adjust them based on the location you select.

Comply with Local Zoning Regulations

Whether you intend to buy, rent, or construct a building for your business, it’s essential to comply with local zoning requirements.

Neighborhoods are typically designated for either commercial or residential use, and zoning regulations may prevent certain kinds of businesses from operating in a given area.

Even if you plan to establish a home-based business, it’s crucial to keep in mind that zoning regulations may still apply.

Zoning laws are usually managed at the local level, so it’s best to consult your local municipal planning department or a comparable office to determine which zoning laws are applicable to you.

Tax Considerations

The tax landscape of the state, county, and city can significantly affect your business. Income, sales, and real estate taxes, as well as corporate taxes, can vary greatly depending on your location.

Some states offer favorable tax environments for certain types of companies. Research state and local government websites to learn about tax incentives in your region.

Government Incentive

Many state and local governments offer special tax credits, small business loans, and other financial incentives to small businesses. Incentive and benefit programs are usually related to job creation, energy efficiency, urban development, and technology

Visit the websites of local SBA offices, Small Business Development Centers, Women’s Entrepreneurship Centers, and state and local governments for more information on incentive program

Federal Government Benefit

Small businesses located in underutilized areas and with government contracts may be eligible for federal government benefits. Check the Historically Underutilized Business Zones (HUBZone) program to see if you qualify for preferred access to government procurement opportunities.